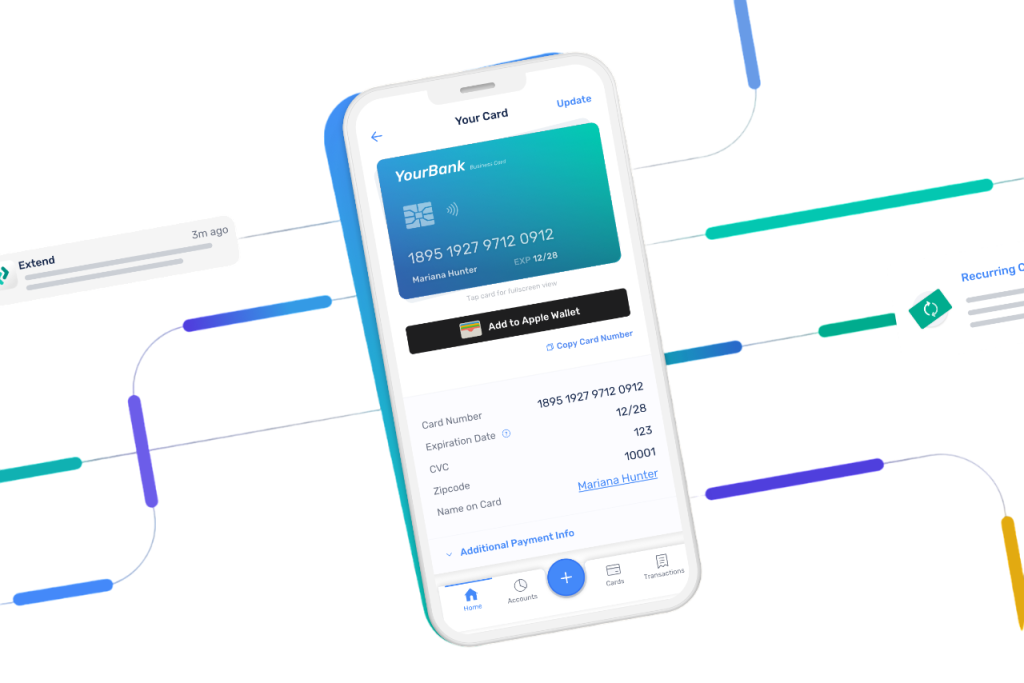

TTR.cash Virtual Cards are a reloadable, digital-first payment solution connected directly to your wallet balance. They give your business immediate purchasing power without the need for any physical card. Designed for global entrepreneurs, agile startups, and modern finance teams, these virtual cards let you spend worldwide with flexibility while maintaining robust control and security. Activated and managed entirely through your secure TTR.cash account (SSO-enabled), Virtual Cards empower you to make global payments instantly and safely – all from an intuitive online dashboard.

Reloadable Digital-First Convenience

Enjoy the ease of a card that is 100% digital and instantly available. There’s no waiting for plastic or dealing with lost cards – your virtual card is issued within minutes and ready to use immediately. Because it’s linked to your TTR.cash wallet, you can reload and use it continuously without separate bank transfers or physical top-ups. Simply fund your wallet, and your Virtual Card draws directly from your balance whenever you make a payment. This means no delays, no plastic, and no hassle in accessing funds for your business needs.

Secure and Fast Online Management With SSO

Manage all your cards in one place with a single, secure login. TTR.cash Virtual Cards are activated and controlled through your online account, which supports single sign-on (SSO) for seamless and safe access. No cumbersome paperwork or separate portals – just log in to your TTR.cash dashboard to create or oversee cards in real time. Granular user permissions allow finance teams to supervise spending across the organization, while individual team members can have cards without ever handling sensitive bank info. Everything is handled through our encrypted, secure platform, ensuring a user-friendly yet enterprise-grade experience.

Multiple Cards for Teams & Budgets

Issue multiple virtual cards per account to organize your spending by team, project, or expense category. With TTR.cash, you can create a unique card for each team member or department, or dedicate cards to specific budget categories (marketing, travel, subscriptions, etc.). This not only simplifies expense tracking but also enhances control – you decide how and where each card is used. Team members get their own card details (with custom labels for easy identification), while administrators get full visibility. Need to set a limit or pause a card? It’s all done in a few clicks, giving you unmatched flexibility in managing company-wide expenses.

Globally Accepted Payments

TTR.cash Virtual Cards are backed by major card networks like Visa and Mastercard, making them accepted by millions of merchants worldwide. Pay suppliers overseas, subscribe to international SaaS tools, or make purchases from global e-commerce platforms with confidence – your virtual card works anywhere these networks are supported. Because the card carries the trusted Visa/Mastercard brand, you get broad international acceptance and currency flexibility. Whether it’s an online transaction in your home country or a payment to a vendor across the globe, your Virtual Card is as good as cash – wherever your business takes you.

Ideal for Global Business Spending

Virtual Cards from TTR.cash are a perfect fit for a wide range of business payment needs. For example, you can use them for:

Global purchases and supplier payments – Streamline payments to international vendors and marketplaces with ease.

Digital subscriptions and SaaS services – Manage recurring software fees or cloud services without using personal cards.

B2B payments to partners or contractors – Settle invoices or one-time business expenses in a controlled, trackable way.

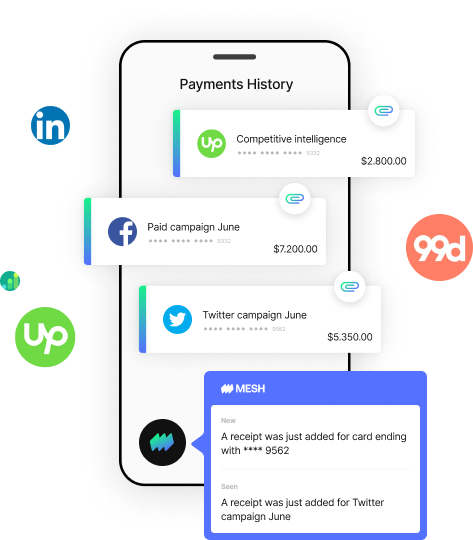

Online advertising and marketing spend – Allocate specific cards for ad campaigns (Google, Facebook, etc.) to track and cap your budget.

Software licenses and cloud expenses – Pay for licenses, hosting, and other online services, keeping these costs separate for clarity.

…and more – Essentially any online or card-not-present transaction where you want convenience, security, and spend control. Virtual Cards give you the agility to handle business expenses of all kinds, on a global scale.

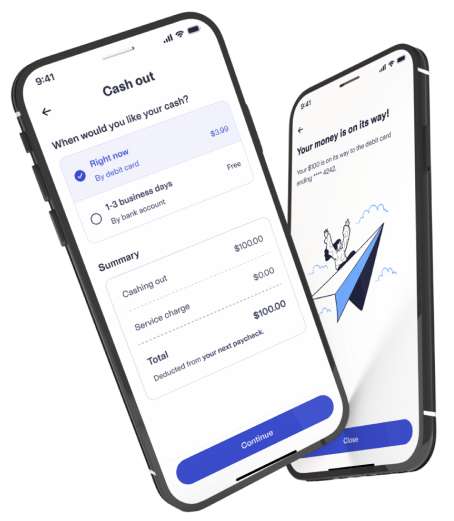

How to Request and Use Your Virtual Card

Getting started with TTR.cash Virtual Cards is quick and straightforward. Here’s how it works:

1. Log In Securely: Sign in to your TTR.cash account through our secure platform (single sign-on enabled).

2. Request a New Card: Navigate to the Virtual Cards section of your dashboard and click “Request New Card.”

3. Configure Your Card: Enter a card nickname or assign it to a team member/purpose. (You can also choose currency and set a spending limit or budget for the card, if desired.)

4. Instant Issuance: Submit your request – your virtual card is generated instantly. The card number, CVV, and expiration date will be provided right away in your account.

5. Fund and Activate: Ensure your TTR.cash wallet has sufficient balance to use the card. (Top up your wallet as needed – the virtual card draws funds directly from your wallet balance, so no separate loading is required.)

6. Start Spending Globally: Use your new virtual card for purchases anywhere Visa/Mastercard are accepted. Simply enter the card details at online checkouts, or add the card to your mobile wallet (Apple Pay, Google Pay, etc.) for convenient in-store and online payments.

7. Manage in Real Time: Monitor transactions as they happen in your dashboard. You can download expense reports, set up real-time spend alerts, or freeze/unfreeze and cancel the card anytime with a click.

Full Spending Control & Real-Time Reporting

Maintain complete control over your business spending with powerful management tools. Each Virtual Card can have custom spending limits – set daily or monthly caps, or per-transaction limits, to prevent overspending. All transactions update in real time on your TTR.cash dashboard, giving finance teams immediate visibility into who’s spending what. You can filter expenses by card or team member, making reconciliation and reporting a breeze. Enable real-time notifications to get instant alerts whenever a card is used, keeping you informed of all activity. With detailed reports and analytics at your fingertips, staying on top of company expenses has never been easier.

Advanced Security Built In

Security is at the core of the TTR.cash Virtual Cards experience. Our virtual cards leverage tokenization, which replaces sensitive card details with encrypted tokens – adding a layer of protection whenever you make a payment. Funds are accessed at the wallet level, meaning your money remains safely in your TTR.cash account until a transaction is authorized (no large pre-loaded balances sitting on an exposed card). Plus, there’s zero risk of physical card loss or theft – with no plastic card, you eliminate the chance of it being lost, stolen, or skimmed. We also employ robust fraud monitoring and 3D Secure authentication on transactions to safeguard your payments. If suspicious activity is detected, you can instantly freeze the card in your dashboard, stopping fraud in its tracks. TTR.cash Virtual Cards provide peace of mind through multi-layer security, so you can focus on your business knowing every transaction is protected.

Transparent Fees with No Surprises

Enjoy a transparent and fair fee structure that adapts to your usage. TTR.cash Virtual Cards come with clear, upfront pricing – there are no hidden charges, and all fees depend on your usage and membership tier. Whether you’re on a free startup plan or a premium enterprise package, you’ll know exactly what small issuance or transaction fees apply (if any) before you commit. We believe in total transparency: you only pay for what you use, and as your business grows, our flexible plans ensure you continue to get great value. No monthly maintenance fees and no unwelcome surprises – just simple, predictable costs aligned with your needs.

Get Started Today!

Ready to empower your team with smarter spending? TTR.cash Virtual Cards give you the agility of instant, global payments combined with the oversight and security that growing businesses require. Whether you’re a startup founder looking to streamline subscription payments or a finance manager enhancing your company’s expense controls, our Virtual Cards are the innovative solution to take you forward. Sign up today and discover how easy it is to manage corporate spending in a modern, cashless way – with TTR.cash by your side, anywhere you do business.