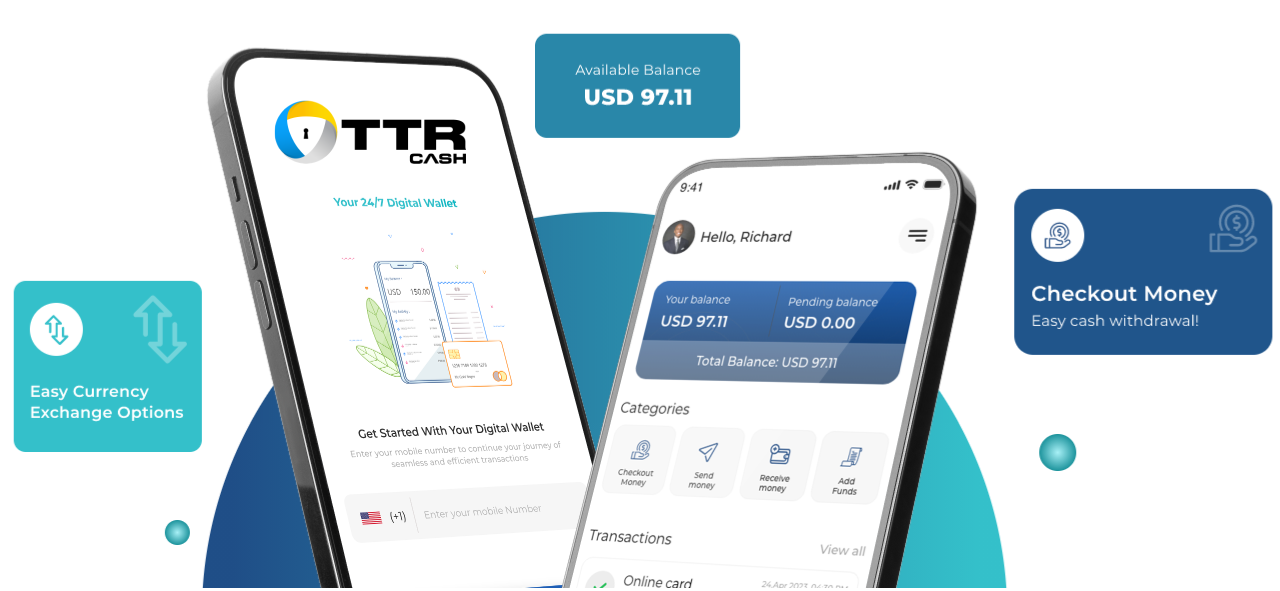

Simplify your international finances with TTR’s Digital Wallet Management service. Our platform lets you manage multiple currency wallets in one secure account, so you can easily receive, store, send, and exchange funds worldwide from a single dashboard. Each wallet works like a crypto wallet behind the scenes – uniquely addressable and highly secure – but with the user-friendly experience and compliance of modern fintech. In short, we combine the flexibility of decentralized wallets with the trust and simplicity of traditional banking, giving you the best of both worlds.

Key Features and Benefits

Multi-Currency Wallets, One Account

Open and manage multiple wallets for different currencies under a single TTR account. There’s no need for separate bank accounts – hold various currencies in parallel, each in its own wallet. Every wallet you create is assigned a unique hash-coded address for internal use, providing a secure way to identify your wallets (much like a crypto wallet address).Worldwide Deposits & Withdrawals

Funding your wallets or cashing out is fast and flexible. You can deposit funds via bank transfer, supported online payment services, or even cryptocurrency – whichever suits you best. All deposits route to accounts owned by TTR.cash and are quickly credited to your chosen wallet. When you need to withdraw, you have options: send funds to your own bank account or even directly to another user’s account, as long as the necessary verification is in place. Payouts can be processed instantly or via a short review, and our system even supports automatic withdrawals via API integration.Seamless Transfers & Currency Exchange

Easily move money between your wallets or to other users within the TTR.cash network. For example, you can instantly transfer funds from your USD wallet to your EUR wallet (or vice-versa) at the live exchange rate. The platform updates FX rates continuously (every 20 seconds) and locks in the current rate at the moment you confirm the transfer. Sending money to another TTR.cash user is just as simple – use their wallet ID to transfer internally, avoiding traditional bank delays altogether.- Real-Time Balance Updates

Stay on top of your finances with live data sync across all your wallets. Your dashboard reflects every transaction immediately – when funds arrive or move, your balance updates on the spot. Exchange rates are refreshed in real time to ensure you always see an accurate conversion value. You can even set up instant alerts to notify you of important activities, so you’re always informed.

Scalable & Integration-Ready

TTR.cash is built to scale with your needs. Whether you have one wallet or one hundred, a few transactions a week or thousands per day, our infrastructure handles it with ease. For entrepreneurs and businesses, our platform offers integration capabilities to streamline your workflow. Use our APIs to connect your TTR.cash wallets with your own applications or ecommerce systems – automate transfers, trigger payouts, and synchronize data in real time.Secure & Compliant by Design

We adhere to strict international compliance standards and KYC protocols for all users, adding a strong identity layer to your wallets. All transactions are monitored and reviewed to prevent unauthorized activity, and your data is encrypted and stored securely. TTR.cash blends bank-grade security with crypto-level privacy, ensuring a safe environment for your money.

Managing Your Wallets: Step-by-Step Guide

1. Create a New Wallet

Once your account is verified, you can create as many wallets as you need. Log in to your TTR.cash dashboard and select “Add New Wallet.” Choose the currency and label it. A wallet is created instantly with a unique wallet ID (hash code) that identifies it securely.

2. Deposit Funds into a Wallet

Select the wallet you want to fund and choose your deposit method: bank transfer, e-wallet, or crypto. The platform provides you the required details (account number, crypto address, etc.). Once received, the funds are credited to your wallet balance instantly.

3. Transfer or Exchange Between Wallets

Initiate an internal transfer between your wallets. Choose source and destination wallets, input amount, and view the real-time conversion preview. Confirm the transfer to lock the rate. The funds move immediately and securely.

4. Withdraw Funds to an External Account

From your dashboard, create a withdrawal request and choose the wallet and destination (your account or a third-party account). Follow the prompts. Most transactions process instantly; some may undergo a quick review for security. You’ll receive notifications at every step.

5. Monitor and Manage Balances

Your dashboard shows all wallet balances in real time. You can view transaction history, filter activity, and download reports. Alerts notify you of events like new deposits or low balances. Access your wallets anytime via desktop or mobile – you’re always in sync with your funds.

Built for Global Entrepreneurs

TTR’s Digital Wallet Management is designed for modern entrepreneurs, freelancers, and businesses operating globally. Whether you’re an e-commerce seller, a remote professional, or a startup managing international payments, our platform adapts to you.

You can move and manage money across currencies, wallets, and borders without unnecessary delays or hidden fees. The interface is clean, secure, and responsive, and all compliance is handled behind the scenes.

Whether you’re scaling into new markets or simply streamlining how you handle funds, TTR provides a future-proof foundation for your financial operations. With real-time access, flexible wallet tools, and global compatibility, managing money has never been this intuitive.